We recently released Card Check, a new feature to assist gaming operators with conducting KYC checks during the pay out journey for customers. It means you can avoid fraud at pay out and ensure that your business is able to quickly identify instances of account takeover.

This was a client-led development, one of the advantages of being a fully digital KYC provider is that we’re able to tailor products to client needs. Quite often we’re able to offer what other KYC providers don’t have in their locker.

Here’s a webinar (now on-demand) we ran recently that focuses on the benefits of Card Check and we polled our audience to identify how y gaming operators, are securing their pay out journey. Here are the results:

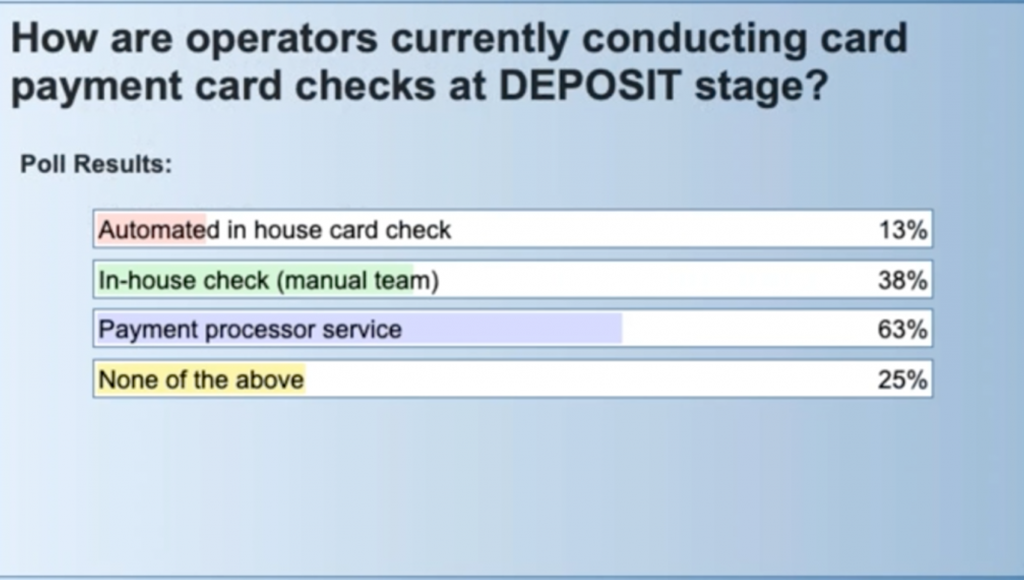

Card Check when depositing funds

The results were surprising. There are two key elements to the online gambling customer experience: the deposit stage – where customers pay funds in to gamble, and the pay-out stage – where the customer (hopefully) withdraws their winnings. We asked our audience about both of these stages of the journey and the results showed that when carrying out card checks during the deposit stage, most preferred to have the payment processor do the work without having any intervention in the process themselves.

But what’s more striking, is that 25% of our audience, did not appear to use any of the three major options to conduct card checks at the deposit stage. This may be because of the risk-based approach of each operator.

Easily accepting money-in may reasonably be viewed as less hazardous than when paying out and more conducive to inviting customers to engage with betting activity. Arguably this isn’t an issue as with a thoroughly compliant pay out journey there are no problems and other KYC checks are done during the onboarding journey anyway.

The 38% who are doing in-house checks via a manual team for deposits is probably the most surprising statistic. Manually checking debit cards for pay outs is a laborious process that can easily be automated, so it’s concerning to see that so many businesses are losing time in this way.

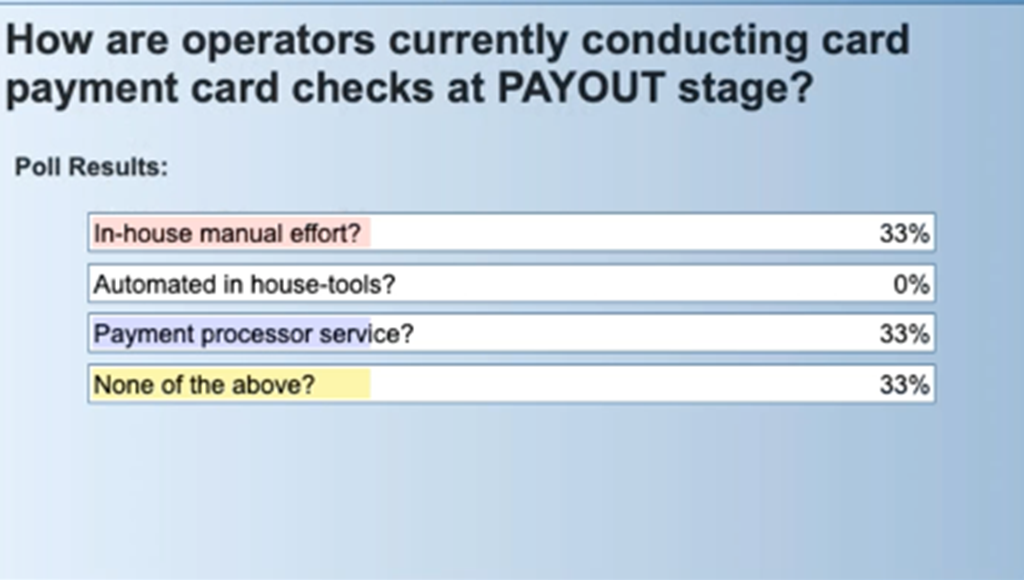

Card Check at pay out journey

When we asked about how gaming operators approach the pay out stage of the customer journey, we had far more surprising results:

None of this was done via automated tools compared to 13% when dealing with deposits and ‘none of the above’ went up. It’s a surprise as the pay out stage of the journey is far riskier for operators than the deposit stage. That’s where we would expect to see gaming operators to clamp down on making sure they were paying out to the right customer account through Card Check.

Payment processor services are a fine choice and take an equal share of first place in the survey. But how sustainable is it as gaming operators are expected to deliver pay outs at an increased pace? The same goes for in-house manual efforts.

Faster Payments allows for customers to withdraw their winnings within a matter of hours rather than 1 to 5 days, as is currently standard for many gaming operators.

But as more savvy online gaming operators begin to offer Faster Payments services to connect customers with their winnings quickly, there will be a growing expectation that other operations do the same.

Once this happens, slow and laborious processes will no longer be tolerated by customers and could see significant losses as customers move to different operators. With only 5% of the British customer base for online gaming providing 70% of the revenue according to a recent study, losing customer-share is not a risk that can be taken lightly.

The growing demand for gaming operators to user Faster Payments so that customers can access their winnings faster is a concern but is one easily remedied with the right tools.

Checking payment cards has become mandatory in Portugal and that was due to anticipatory legislation in the face of the Fourth Anti-Money Laundering Directive (4AMLD) that was issued by the European Union.

While the UK may no longer be a part of the EU, 4AMLD is very much a part of the law of the land and it affects every single EU territory. The crackdown from legislators has not come into force yet but it is on the horizon and your businesses’ pay out journey will be under scrutiny sooner rather than later.

Find out more about Card Check by watching our webinar on-demand. Or email the team here so we can set you up with a demo.