Proving identity online is no simple business. Thanks to the rise of synthetic identities, online fraudsters, and other criminals it’s becoming increasingly more complex to discover whether or not the customer you’re onboarding is who they say they are.

At HooYu, we’re dedicated to helping you identify your customers. To help you elevate your KYC process in 2021 we’re introducing a faster way to verify customers are who they say they are using our payment card referencing process, Card Check, when paying out funds.

What is Card Check?

Card Check is an extension to the HooYu journey we’ve designed based on requests from clients. It is especially valuable for those in the gaming sector who want to make sure their pay out process is compliant and sees funds transferred to the right person.

Using this new feature, you can reference the customer payment card data you have on file against the data that HooYu extracts from the payment card. Card Check provides a simple and efficient verification on the recipient of the money that’s moved through your accounts. It’s a measure to show your regulator that you take AML controls on pay outs seriously and prevents the vast majority of fraudsters from taking advantage of your business.

Preventing crime at pay out

Payment cards are an important feature in the pay out process for most online gaming journeys. It’s a quick and easy way to verify that the account receiving the player’s winnings belongs to that individual and there are no bad actors taking advantage of your business to launder illicit money.

For gaming operators, payment card referencing is the fastest way to verify that the customer they’ve onboarded is the one receiving money generated from the business. It’s also another proof point that the customer is who they say they are, increasing business security and elevating the compliance process.

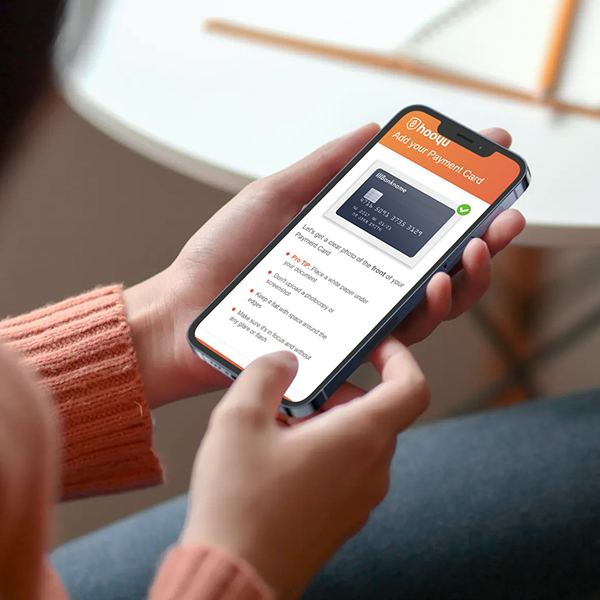

Card Check is available in the new HooYu user interface and reduces manual overhead when gaming operators need to be sure that they know whose card is being paid out to, if it matches customer details on file, and make sure that gaming firms aren’t facilitating a fraudulent pay out.

Money launderers are notorious users of gaming operators both in the physical and digital space. But that no longer needs to be the case. HooYu’s payment card referencing tool allows you to stop them in their tracks. Without a physical card linked and verified to the customer who’s withdrawing the funds, you can halt their payment with the click of a button.

Our new Card Check feature works seamlessly with our existing KYC infrastructure to prevent and detect account takeover and identity theft. The fraudsters that have targeted your business will have lost one of the most common ways to launder money through the gaming sector.

How is it done?

HooYu clients can trigger a request either in conjunction with other HooYu elements such as liveness detection or as the sole component of the request. Clients can determine which card they want the user to provide and for the user it appears as a normal part of the HooYu journey integrated into your site or app and they are asked to submit an image of their payment card ending for example, <1234>. Our computer vision technology then gets to work to review the data in the card, validate the 16 digit PAN and check that the card is still valid.

If the card number or card holder name don’t match what the operator has on file, a prompt will nudge the customer to provide an image of the correct card with the numbers requested.

When the card is undergoing the check, the process is entirely PCI DSS compliant and no sensitive card information is stored and the CVV is never captured.

Thanks to our ISO 27001 and Cyber Essentials Plus processes and certifications, all of this data is handled securely.

The images of the card captured by the process are redacted immediately to only have the necessary information for validation and are then expunged within 72 hours – the audit trail of the card referencing action in the HooYu activity log remains to help track what the customer has done, if the journey ever needs to be reviewed.

Payment card referencing provides gaming operators and other financial institutions with a quick and low-stress verification service for customers. It makes it harder for criminals to ingratiate themselves with your business and provides an added layer of security to your transactions with your customers.

For more information on improving the pay out process for your customers get in touch.