The UK Gambling Commission has announced the introduction of new rules focused on stricter harm prevention measures.

From 12 September 2022, operators must “identify, interact with and evaluate” all players to provide at-risk gamblers with greater support as part of a new social responsibility code.

The new rules follow a wide-reaching consultation report, published on 14 April, which included engagement with consumers, those with lived experience of gambling harms, the online gaming industry, financial sector and other regulators. The proposals apply only to online gambling – not to tracks or gambling premises – and form part of the Gambling Commission’s ongoing work to improve consumer protections in online gambling.

Existing requirements place a duty on remote operators to “interact in a way which minimises the risk of customers experiencing harms associated with gambling”. The Commission identified that, while remote operators had the ability to interact with those being harmed, they were not always being “sufficiently curious” about potentially at-risk customers or acting quickly enough when potential harm is identified.

In March of this year, Sky Vegas was fined £1.2m for sending free casino “spins” to 41,395 recovering addicts who had self-excluded from the online gambling site. Sky Vegas is one of a number of major brands recently hit with penalties for failing to protect vulnerable players in recent months.

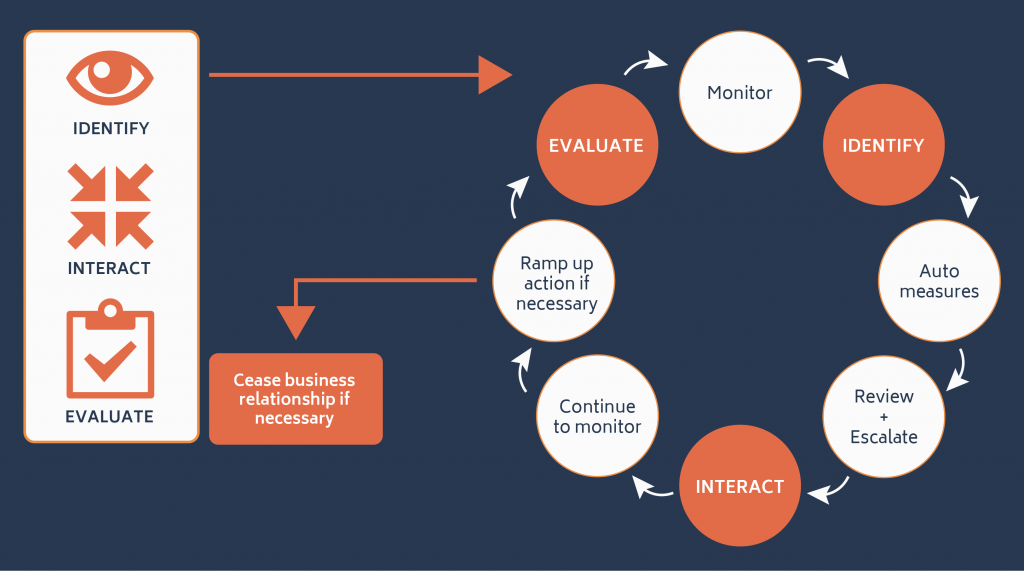

As a result of this consultation, from September, licensees must implement effective customer interaction systems and processes that embed three essential elements – identify, act and evaluate – and which reflect that customer interaction is an ongoing process.

Operators will be required to monitor a number of factors to identify gambling-related harm including customer spend, patterns of spend, time spent gambling, gambling behaviour indicators, customer-led contact, use of gambling management tools and account indicators.

In addition, operators must instigate processes that:

- Provide tailored action at lower levels of indicators of harm that seeks to minimise future harm

- Increase action where earlier stages have not had the impact required

- Ultimately refuse service or end the business relationship where necessary.

The rulings also make specific reference to reducing or preventing marketing or the take-up of bonus offers to at-risk customers.

For more information, or a demonstration of how the HooYu platform can help you meet your harm prevention obligations contact marketing@hooyu.com

At HooYu we specialise in customer onboarding and KYC. Our award-winning platform and market-leading approach to KYC – combining affordability checks, open banking, anti-money laundering screening and user-friendly UI & UX – means HooYu is trusted by NatWest, Virgin Money and online gaming firms such as Betfred, Tombola and MrQ to ensure they meet their regulatory obligations and maximise the percentage of customers being successfully onboarded.